1st Part:

eCommerce European Market: features and opportunity

- European Union

- Ecommerce Europe

- European Population

GDP* of Europe

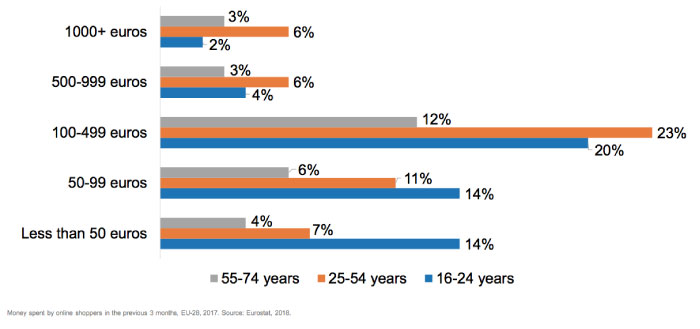

25-54 year-olds purchase - Students & the highly-educated

- Most spent between 100– 500€

- Clothes & Sports and Travel

- Southern European Ecommerce

- eCommerce in United Kingdom

- eCommerce in Italy

- eCommerce in France

- eCommerce in Germany

- eCommerce in Spain

- eCommerce in Poland

- eCommerce in Czech Republic

- Implications of Brexit on cross-border eCommerce in EU

- Amazon is the most important

- Marketplace for eCommerce

- How much money does Amazon make in Europe?

2st Part:

EU Balanced solution for taxing the Digital Economy

- A Level Playing Field for the EU Digital Market

- New EU Value Added Tax (VAT) rules for eCommerce

- The first wave of new rules applicable as of 2019

- The MOSS Scheme

- EU Threshold for No MOSS Services & Products

- Extension of the MOSS: the OSS SCHEME from 1/1/2021

- New rules: use of the IOSS Scheme

- The Working Process of VAT

- Case Study: distance sales from Iceland (no EU) to the EU

- 1. VAT Registration

- 1. VAT Registration and Fiscal Representative

- 2. Supply of Goods

- 3. VAT Return

- 4. VAT Payment

- 5. VAT Listing

- What Now?

Presentation

- 2016 – Now: Partner – BMGR Chartered Accountants & Legal Advisors.

- 2016 – Now: Established and major partner – Financial, Accountancy and Tax, Marketing and Strategy Director in Amazing Eataly Limited (trading as UnKnownItaly), based in Edinburgh (UK). UnKnownItaly is a warm-hearted business specializing in the importation and sale of Italian genuine and fine quality food & beverage in Scotland and UK.

- 2010 – 2011: Master’s Course in Business Arbitration – Foundation of Chartered Accountants in Milan.

- 2003 – 2004: Master’s Degree in Management, Business, Administrative and Financial Consulting – Università Cattolica del Sacro Cuore in Piacenza (Italy).

2000 – Now: Chartered professional Advisor at the Court for Company Restructuring and re Organization. - 1991 – 1995: Degree in Economics and Management – Università Cattolica del Sacro Cuore in Milan.

- 1998 – Now: Chartered Accountant, Tax and Legal Advisor.

BMGR Specialized in professional consulting services, supporting the costumer in all his operational needs, focused on:

- Administrative, Accountancy & Tax Services, Market Analysis, Economics, Financial and International Planning

- Business structuring and consolidation of new settled companies and business units of non-resident companies, especially operating in Italy and UK, in the EU market, Law and Taxation System.

- Vat Registration and Declarations, Unified Tax Return, Property Tax declaration, Tax and Vat consolidation, registration of contracts with the Revenue Agency

- Contract Management and Invoicing between Italian and foreign subsidiaries

- Optimization of the Operating and Management System for complete automaton of data and reports

- Preparation of procedures with the various business areas in order to monitor and optimize compatible data flows, purchasing procedures, expense reports, use of company assets, communication between the various company areas.

European eCommerce Market: a big opportunity for cross-border

- Revenue in the eCommerce market will amounts to US$346,155 m in 2019.

- Revenue is expected to show an annual growth rate (CAGR 2019-2023) of 8.5%, resulting in a market volume of US $479,131 m by 2023.

- The market’s largest segment is Fashion with a market volume of US$100,128 m in 2019.

- User penetration is 70.1% in 2019 and is expected to hit 76.1% by 2023.

- The average revenue per user (ARPU) currently amounts to US$582.43.

Source: Statista

European Union

The European Union (EU) is an economic and political partnership between 28 European Countries. The Eurozone identifies the 19 Countries that have adopted a common currency (euro).

Ecommerce Europe

E-commerce Europe is the voice of the European digital commerce sector; through its 20 national e-commerce associations act at European level to help legislators create a better framework for online merchants, so that their sales can grow further.

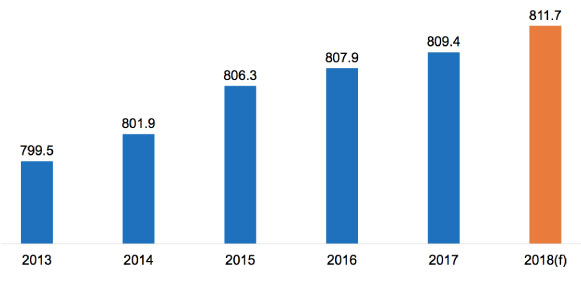

European Population continues to increase (millions)

f=forecast (confirmed)

Source: Ecommerce Europe

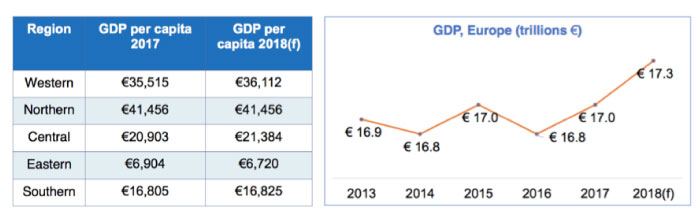

GDP* of Europe is 17 trillion euros and increasing

*Gross Domestic Product (GDP)

Source: Ecommerce Europe

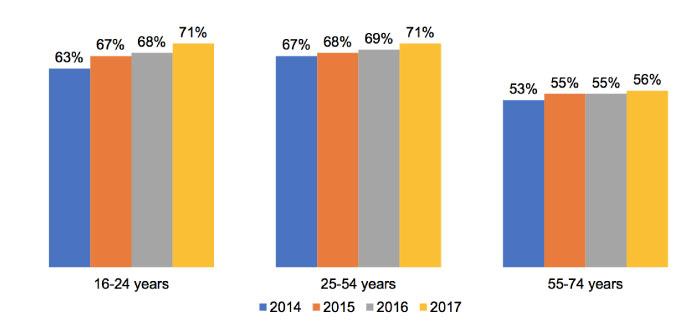

25-54 year-olds purchase most frequently online

Source: Ecommerce Europe

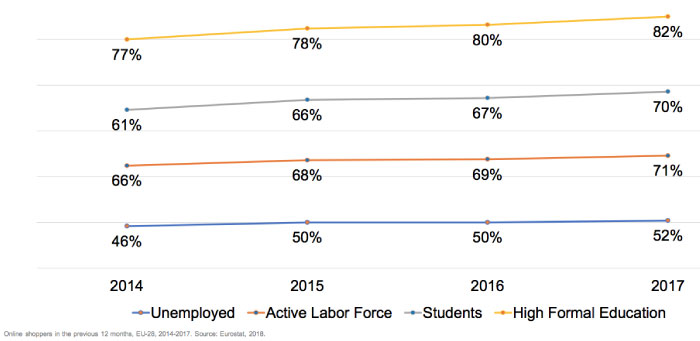

Students & the highly-educated shop online more regularly

Source: Ecommerce Europe

Most spent between 100–500€ over the last 3 months

Source: Ecommerce Europe

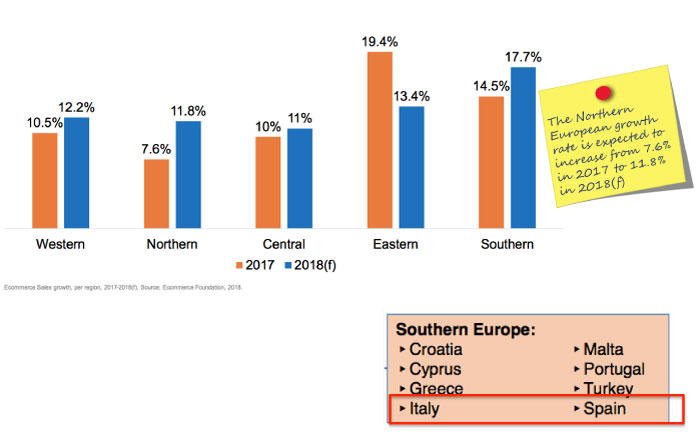

Southern European Ecommerce is on the rise

eCommerce in United Kingdom

Quick introduction

- Population: 66.1 million

- Currency: Pound sterling

- VAT: 20%

- GDP per capita: 33.918 euro

- LPI Ranking*: 8

Ecommerce facts & figures

- Internet penetration: 95%

- % of e-Shoppers: 81%

- X-border shoppers: 36%

- Growth 2016-2017: 8.26%

Delivery Method Preference Use

- Home delivery during the day 72%

- Delivered to my mailbox/ Multi-occupancy mailbox by carrier 42%

- Home delivery during the evening 27%

- Collect it myself from a distribution point 25%

eCommerce Environment

When it comes to e-commerce United Kingdom is the absolute leader in Europe.

UK e-shoppers shop more and spend more compared to other EU countries.

Now that the e-commerce leader is leaving the European Digital Single Market it brings uncertainty for online sellers and buyers.

eCommerce in Italy

Quick introduction

- Population: 59.3 million

- Currency: Euro

- VAT: 22%

- GDP per capita: 26.309 euro

- LPI Ranking: 21

Ecommerce facts & figures

- Internet penetration: 70%

- % of e-Shoppers: 34%

- X-border shoppers: 15%

- Growth 2016-2017: 17.33%

Delivery Method Preference Use

- Delivered to my mailbox 23%

- Home delivery during the day 77%

- Delivery on workplaces 13%

- Unsure, I don’t know 0%

eCommerce Environment

Fashion is the most lucrative segment in online shopping.

Amazon is the most popular B2C online shopping destination.

eCommerce in France

Quick introduction

- Population: 65 million

- Currency: Euro

- VAT: 20%

- GDP per capita: 33.351 euro

- LPI Ranking: 16

Ecommerce facts & figures

- Internet penetration: 88%

- % of e-Shoppers: 67%

- X-border shoppers: 28%

- Growth 2016-2017: 14.3%

Delivery Method Preference Use

- Home or workplace delivery 89%

- Shipping to a pick-up & go location 85%

- Delivery in-store (click & collect) 36%

- Delivery in deposit 11%

eCommerce Environment

France’s ecommerce market is typical of Europe.

There is also some interesting activity in several key areas, like a fast-growing grocery sector.

France also has one of the highest return rates in the world, although high return rates are very common to European markets.

eCommerce in Germany

Quick introduction

- Population: 82.1 million

- Currency: Euro

- VAT: 19%

- GDP per capita: 35.256 euro

- LPI Ranking: 1

Ecommerce facts & figures

- Internet penetration: 91%

- % of e-Shoppers: 77%

- X-border shoppers: 25%

- Growth 2016-2017: 9.5%

Delivery Method Preference Use

- Delivered to my mailbox 23%

- Home delivery during the day/evening 77% / 17%

- Delivery on workplaces 13%

- Unsure, I don’t know 0%

eCommerce Environment

German consumers value familiarity, and are much more likely to purchase from a recognized webshop rather than an international shop.

To get around this, foreign retailers should ensure they have a .de domain if possible to instill a bit more trust and familiarity.

Additionally, according to German law, consumers have a right to return their online purchases within 14 days with no explanation, which is an issue to consider when expanding to Germany.

eCommerce in Spain

Quick introduction

- Population: 46 million

- Currency: Euro

- VAT: 21%

- GDP per capita: 24.594 euro

- LPI Ranking: 23

Ecommerce facts & figures

- Internet penetration: 85%

- % of e-Shoppers: 57%

- X-border shoppers: 27%

- Growth 2016-2017: 15.23%

Delivery Method Preference Use

- Home delivery during the day/evening 53% / 46%

- Delivered to my mailbox by mail carrier 30%

- Delivery on workplace 11%

- Unsure, I don’t know 2%

eCommerce Environment

Fashion is the most lucrative segment. 17% of those buying apparel items in 2017 purchased online, indicating the importance of the in- store experience when buying fashion items.

Some of the most popular B2C online shopping destinations for Spaniards include Amazon.es, Milanuncios, Aliexpress and eBay.

The potential in this market can be demonstrated by the expansion into the country by Richard Liu, the CEO of Chinese online retailer JD Group.